Fundamentals of Mutual Funds- Series 4

📈Demystifying Equity Mutual Fund Categories: A Comprehensive Guide

Good day, readers.

Welcome to this week's issue of "We Weekend".

My previous newsletter series, titled "The Fundamentals of Mutual Funds," aimed to help beginners understand the basic concepts of mutual fund investing with clear explanations and practical examples.

Those who haven't read.…follow the links 👇

Fundamentals of Mutual Funds- Series 1

Fundamentals of Mutual Funds- Series 2

Fundamentals of Mutual Funds- Series 3

We have a lot of options in today's fast-paced world. The paradox of choice can make us feel overwhelmed and unsure about the decisions we make, whether we are trying to choose the best mutual fund from what seems like a long list of options or the best car, TV, or smartphone. People often think that having a lot of choices is a sign of growth and freedom, but it can also cause confusion and doubt and make it challenging to make a decision.

Picture this: You walk into a busy coffee shop, and you're thinking, "I just want a good old cup of coffee." But hold on a second! Instead of the usual coffee aroma, you're confronted with a menu that's like a never-ending story. There are cold brews, lattes, cappuccinos, and enough flavored syrups to make your head spin. You were just in the mood for a simple coffee—nothing fancy. But this menu has made your coffee order more complicated than expected.

Imagine you're looking to invest in mutual funds. Your goal is simple: find a mutual fund scheme that fits with your financial goals, taking into account risk, liquidity, and tax impact. However, as you learn more about mutual funds, you'll see that there are many different categories of mutual funds, from debt mutual funds to equity mutual funds, and each has its own complexities.

Because there are so many options available in mutual funds, you might delay your investment because of that, which could hurt your long-term financial goals. If you make the wrong choice, it could also cost you money. In this scenario, it's important to find a good mutual fund scheme, which is much like looking for a simple cup of coffee on a menu with a lot of choices.

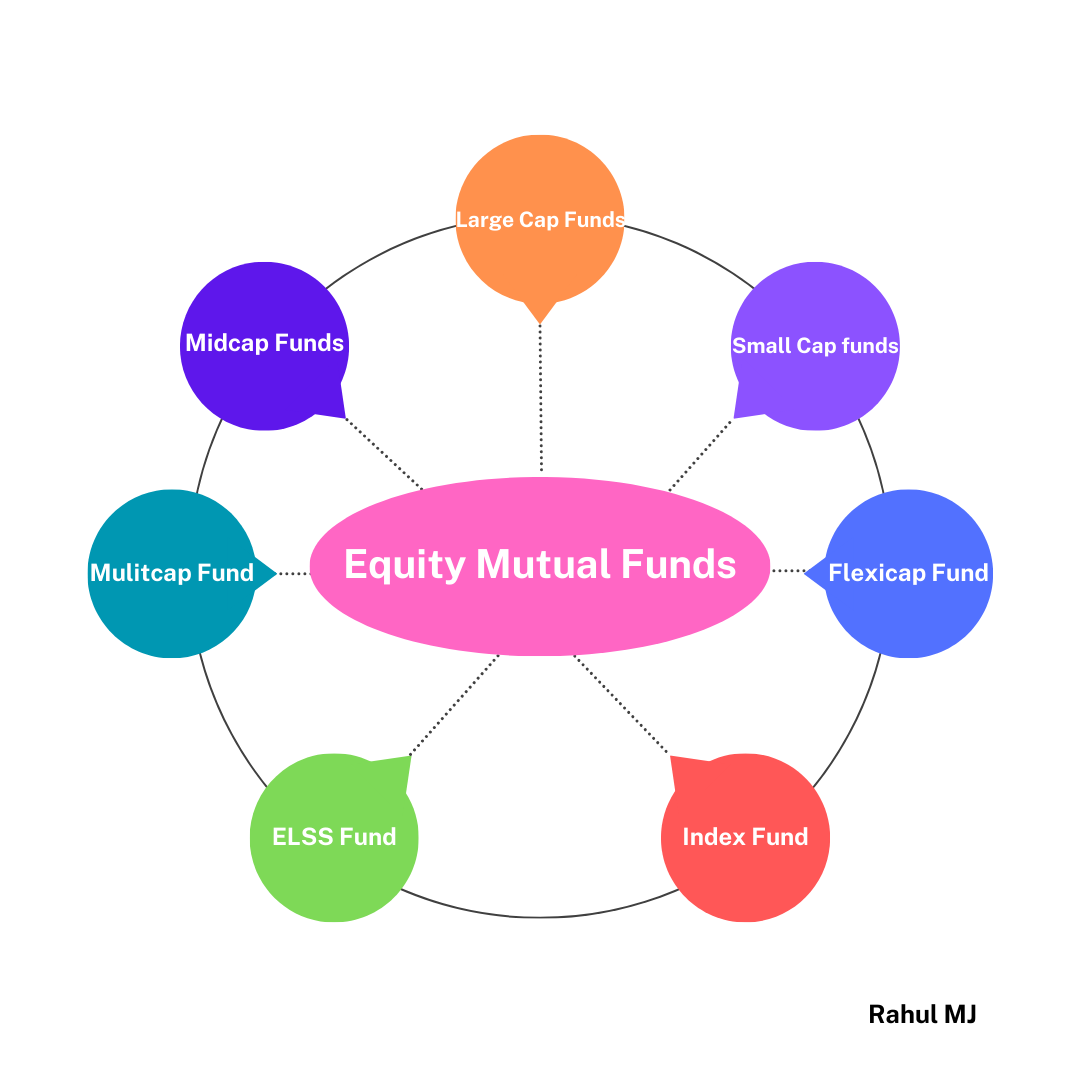

Let's start with a thorough dive into the various types of equity mutual funds in today's newsletter, and we'll move on to debt mutual funds in the next edition of Fundamentals of Mutual Funds.

📈When talking about a mutual fund, what exactly do we mean when we say "equity"?

If you invest in a mutual fund that invests in equity, or the stocks of various companies, that is an equity mutual fund.

Including “equity” mutual funds in investment portfolio is a boost for long-term growth and the potential to beat the inflation rate; however, due to the wide range of schemes offered by these funds, it is important to familiarise yourself with the investing style of each individual equity mutual fund.

Another way to classify equity funds is by market capitalization, which measures the total value of a company's stock in the stock market.

There are large-cap, mid-cap, and small-cap

👉 You can read more about Market Capitalization here.

For better understanding of this categories, the SEBI, the capital market regulator, has defined large-cap, mid-cap, and small-cap.

Large Cap Funds: Invest in the top 100 companies in terms of market capitalization. Some examples would be HDFC Bank, Titan Company, Bajaj Finance, Maruti Suzuki, Infosys, TCS, etc.

These companies have been around for a long time, are stable, and have a good image with all of their customers. They also have good management. They have matured, and their "moat" signifies a competitive advantage that not only allows them to produce supersized profits but also ensures that they will continue to make money even if the economy were to collapse. Any scheme invested in these companies will be called "large cap." These businesses have a great track record of generating wealth for their investors over a long period of time.

Midcap Funds: Invest in the 101st–250th largest companies by market cap. Companies like Astral Pipes and Adani Power, as well as IDFC First Bank and Page Industries, are typical examples. These firms are rapidly expanding and may one day join the ranks of the large-cap categories of mutual funds

The investor in this mid-cap fund is taking more risk in the hopes of larger returns than they would receive from a large-cap fund.

Small Cap Funds: Invest in the 251st company onwards in terms of market capitalization. A few examples of such businesses are PVR Inox, IEX, Cochin Shipyards, and Avanti feeds Ltd.

These small-cap funds are more volatile or riskier than their large and mid-cap companies, but they also have the potential for greater returns and the ambition to join the ranks of the mid-cap and large-cap in the coming years, provided their businesses maintain their growth at the same rate. In addition to being the top performer over the course of a year, small caps are also the first to experience negative returns during market corrections or declines.

Now that you understand the differences between the three primary types of equity mutual funds and the risks and returns associated with each, we can move on to the next set of subcategories: Multicap and flexi cap funds.

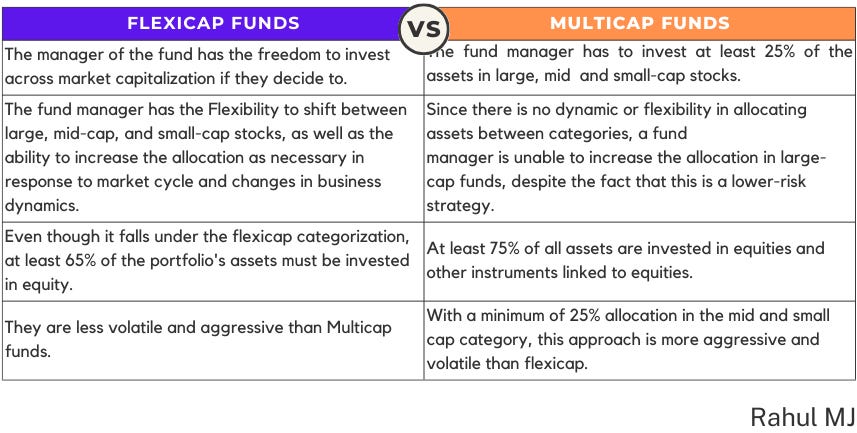

We were aware that that large-cap funds would be invested in large-cap companies, mid-cap funds into other mid-cap companies, and small-cap funds into small-cap companies.

But with the Flexi Cap and Multicap Funds, it will combine all three types into one investment strategy. This means that fund manager will invest across market caps.

Last Category is ELSS Fund

How do ELSS funds work? An Equity Linked Saving Scheme (ELSS) is an equity mutual fund that mostly invests in equity and equity related product.

The Indian government has notified this scheme to claim the tax deduction under Section 80C of the Income Tax Act of 1961.

But it comes with a lock-in period of 3 years, and if you want to withdraw or sell the mutual fund, the holding period of your investment must be completed within 3 years.

However, compared to toxic endowment policies, which agents and insurance companies routinely mis sell, this is the best category of investment for those who want to claim deductions.

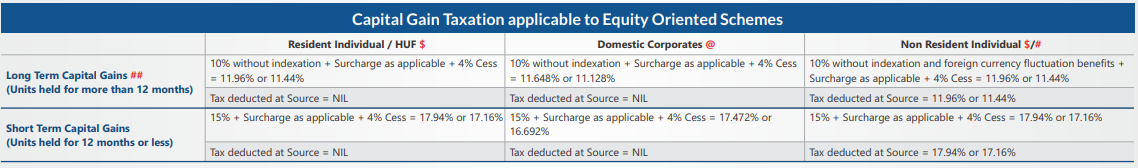

It's important to note that all the equity funds discussed are subject to capital gains taxation. Specifically, gains from redemptions made within one year are subject to a 15% short-term capital gains tax, while gains from redemptions made after one year are subject to a 10% long-term capital gains tax, provided that the gain exceeds one lakh rupees in the financial year.

HDFC Mutual Fund : Tax Reckoner

That’s a wrap!

If you found this post helpful, please like and subscribe so I can bring you more content like this on personal finance.

Questions?

Feel free to contact me at 📧 rahulmjfin@gmail.com or by sending a message to 📞 +9632762919 on WhatsApp.