Good day, readers.

Welcome to this week's issue of "We Weekend".

My previous newsletter series, titled "The Fundamentals of Mutual Funds," aimed to help beginners understand the basic concepts of mutual fund investing with clear explanations and practical examples.

Those who haven't read.…follow the links 👇

Fundamentals of Mutual Funds- Series 1

Fundamentals of Mutual Funds- Series 2

The primary purpose of today's topic is to learn about the different types of mutual funds so that individual investors can figure out which ones are best for them based on their risk tolerance, investment time frame, and financial goals.

There are currently over 1000 mutual fund schemes available to investors, and new mutual fund schemes are introduced every week or every month. No matter how many ways mutual funds are categorised, you'll be able to choose one that suits your needs. I am confident that after reading this post, you will have the knowledge and confidence to select the best mutual funds for your needs.

As we continue our weekly newsletter series on the fundamentals of mutual funds, I'd like to begin with some new concepts.

Open-ended mutual funds vs. closed-ended mutual funds

First Step ➡️ Make sure you're investing your money into open-ended mutual fund schemes.

With open-ended schemes, there is no maturity or lock-in period, and investors can buy and sell mutual funds at the net asset value (NAV) price at any time they want.

But in closed-ended schemes, there will be a period of maturity similar to a fixed deposit. This will be an offer that you can invest in during the launch of the schemes, and it will be called an NFO (new fund offer). After the offer closes, your initial investment will be locked for a certain period, and you won't be able to make additional investments. The maturity amount will be based on the market price at the stock exchange at that time.

✅I would advise only investing in open-ended mutual fund schemes, which are convenient and offer liquidity that can be readily converted to cash.

There are three primary categories of open-ended mutual funds. Many different kinds of mutual funds exist as well.

However, I'll be focusing on the three most common types of mutual funds.

The three types are equity funds, debt funds, and hybrid mutual funds.

Let's understand debt and equity mutual funds a little before I get to hybrid funds.

When it comes to debt funds, your money will be invested in government and corporate bonds with AAA ratings, which carry low risk, both of which offer fixed returns, so there's very little risk involved.

👉Consider applying for a loan from a bank when you need money beyond what you can get from your regular salary to cover an unexpected expense. If your credit score is good, the bank will lend or sanction the loan.

✍Keep in mind that the bank's faith in your creditworthiness is essential to the loan's approval.

A similar principle applies to debt mutual funds, where you, as an investor, lend money to companies in order to support their business operations or help them expand.

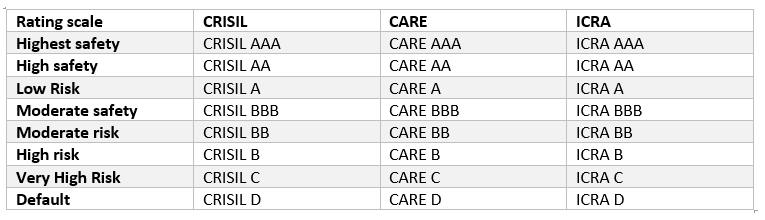

Like a credit score determines whether or not a bank will grant a loan, the Crisil credit rating company certifies companies based on their financial stability and creditworthiness.

Credit rating scale 👇

However, you should be aware that where there's less risk, there's also less return.

☝Although debt funds don't offer higher returns, they're a good way to protect your wealth against fluctuation in the market.

Now coming to the main type of mutual fund, which is equity funds?

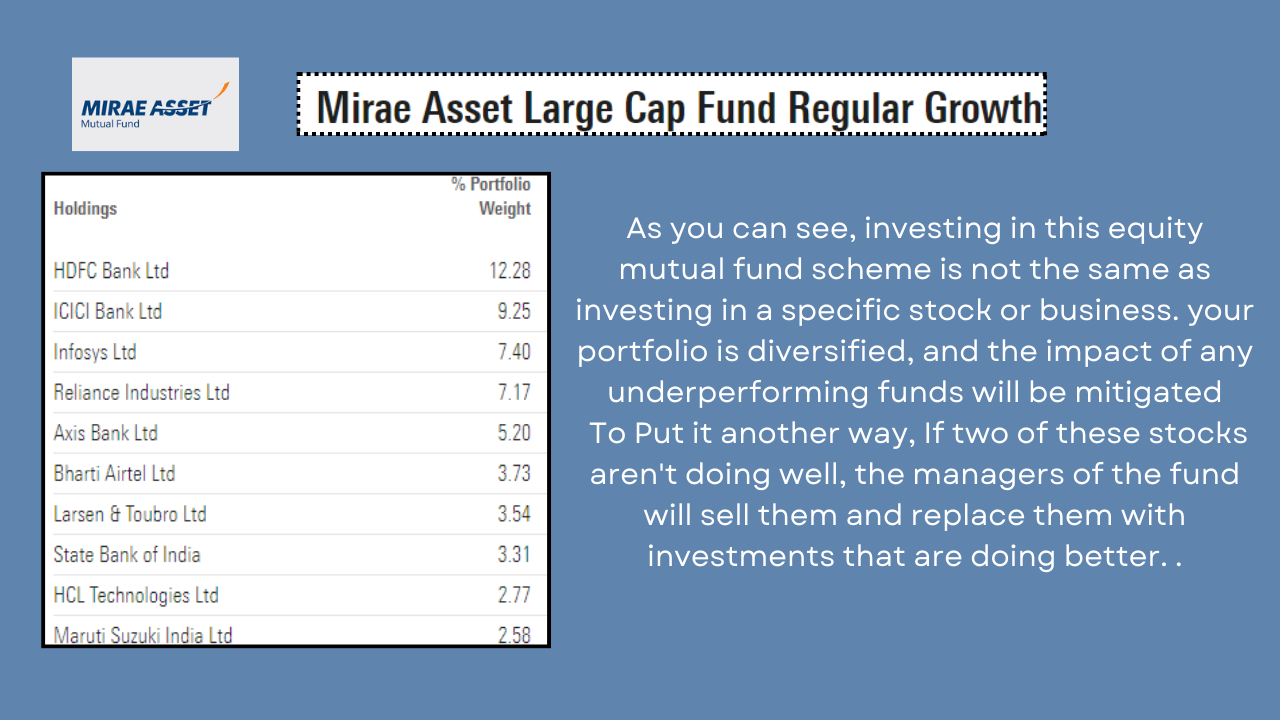

If you invest in a mutual fund that invests in equity, or the stocks of various companies, that is an equity mutual fund.

To better understand the Equity Mutual Fund Scheme and how our money is invested, let's look into an example: 👇

Market capitalization, which is essentially how much the stock market believes the company is worth, can further categorise equity funds.

Market Capitalisation- Explained below 👇

The current market capitalization of Reliance Industries, as you can see, is 16.00 trillion INR, which is about 16,11,396 crore. It means that if you want to buy all of Reliance Industries shares, you have to pay them Rs. 16 lakh crores. I know that in our dream, this won't happen. Therefore, I gave an illustration to make it clear.

The SEBI regulator of the capital market has defined large-cap, mid-cap, and small cap to better understand the method.

Large Cap: Top 100 companies in terms of market capitalization

Midcap: 101st–250th companies in terms of market capitalization

Small Cap: 251st company onwards in terms of market capitalization

Hybrid Funds

Hybrid funds, on the other hand, are a combination of debt and equity. That's why it's called a mixed-asset fund, and there are other subtypes of it, including the aggressive hybrid, conservative, and balanced fund.

If a hybrid fund's equity allocation of 65% is greater than its debt allocation of 35%, it is considered an aggressive hybrid, while the opposite applies to a conservative hybrid.

Considering the size and scope of the topic, the upcoming newsletter will feature a thorough analysis of the mutual fund categories and the pros and cons of each.

That’s a wrap!

If you found this post helpful, please like and subscribe so I can bring you more content like this on personal finance.

Related articles:

Securing Tomorrow: Investing in Our Child's Future Today"

"Unlocking the Potential: The Power of Compounding in Investing"

How to Save Wisely from Your Monthly Salary Before Investing

Know What You're Getting Into Before You Invest

Why Should You Start Investing Early in Your Life?

How to Invest for the Next 10 Years to Secure Your Financial Future?