Securing Tomorrow: Investing in Our Child's Future Today"

"The greatest gift parents can give their children is the ability to manage money wisely, ensuring they have the freedom to pursue their dreams."

Hello Readers,

This week's issue of the newsletter "We Weekend" features an insightful article on a parent's first priorities in their child's education. In some ways, I view it as more important than our retirement goals.

Perhaps you're wondering why? Even if you’re planning for early retirement, achieving this goal for your children may significantly delay your financial freedom. Therefore, this particular goal is very important.

Those who are reading this article have, for the most part, completed their education.

For the sake of clarity and context If you remember, what was the total cost of your education?

Those who earned an engineering degree and an MBA, i.e., both a bachelor's degree and a master's degree, could have spent between Rs. 5 and Rs. 7 lakhs, including hostel fees, living expenses, and food expenses. Those who received a government education seat based on their merit ranking would not be required to pay more than three lakh rupees, in my opinion; however, this would depend on the course or college that we had opted for. Ten years ago, though, the total cost would have been between 5 and 7 lakhs.

Given that the cost of higher education in India is between 12 and 15 lakh rupees right now, I'd want to ask you, if you are already an early parent who is thinking about your children's future, how much it would cost today to acquire both an engineering degree and an MBA from India rather than from abroad? Do you have any clue how much money it would take to provide you with the best possible education for your children right now? Of course, it would be fantastic if you could come up with your own assumption, but if that's too much to ask, then let me make it simple for you.

From what I've discovered, some prestigious institutions would charge Rs 25 lakhs, but the average cost of college in India, including hostel fees, is between Rs 12 lakhs and Rs 15 lakhs. When you add everything up, you get 25 lakhs, and an MBA at a top-tier college would cost at least 15–16 lakhs more.

The total cost of both an engineering degree and an MBA would be at least Rs. 45 lakh.

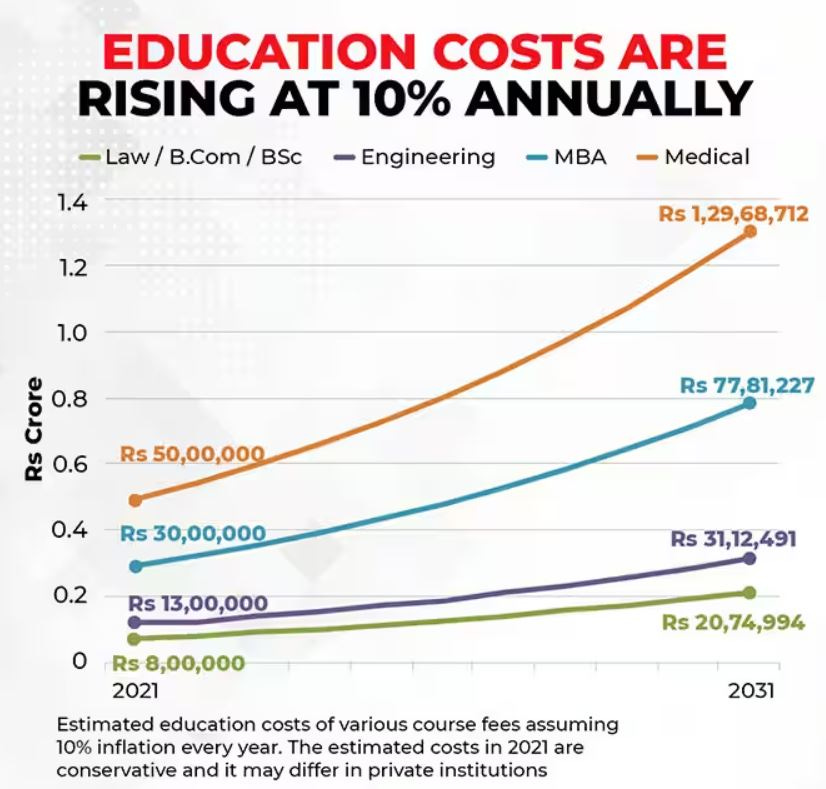

Providing good education for our kids is one of the best investments we can make in their future. It does more than just improve their knowledge and skills; it also provides access to better career opportunities and higher-paying jobs. But from what I understand, the cost of education has been rising at an alarming rate in recent years, something that analysts call "education inflation."

What is education inflation?

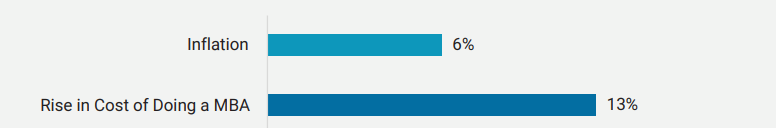

The term "education inflation" indicates a scenario in which the cost of education increases faster than the average rate of inflation. A higher rate of increase in the cost of education compared to the general price level of goods and services is referred to as "education inflation."

Source: Money Control

With the above information, it's clear that increasing costs for education are something parents must take into account when planning for their children's futures. It is crucial that we take action to lessen the burden that rising higher education costs are placing on parents.

Also, making a long-term career plan—which can be done by looking for financial aid and using online learning resources, networks, scholarship opportunities, and advice or mentoring from industry professionals—can help parents make smart decisions about how much their child's education will cost and the amount they should set aside now to fund their child's education rather than facing a cash crunch later on.

Investment plan for children's education.

It's important to start planning your investments as soon as possible and to have a time horizon of at least ten to fifteen years.

A 15-year mutual fund SIP starting with 5,000–7,000 invested in an equity Mutual fund and growing by 10–20% annually could be helpful. However, with the rising cost of living expenses, including loans, it is challenging for parents to save a large sum of money for their child's education goals.

When time is on your side, a systematic investment plan (SIP) and the power of compounding may get you to your goal easily. Rebalance the portfolio as you come closer to your goal, and increase your exposure to debt schemes.

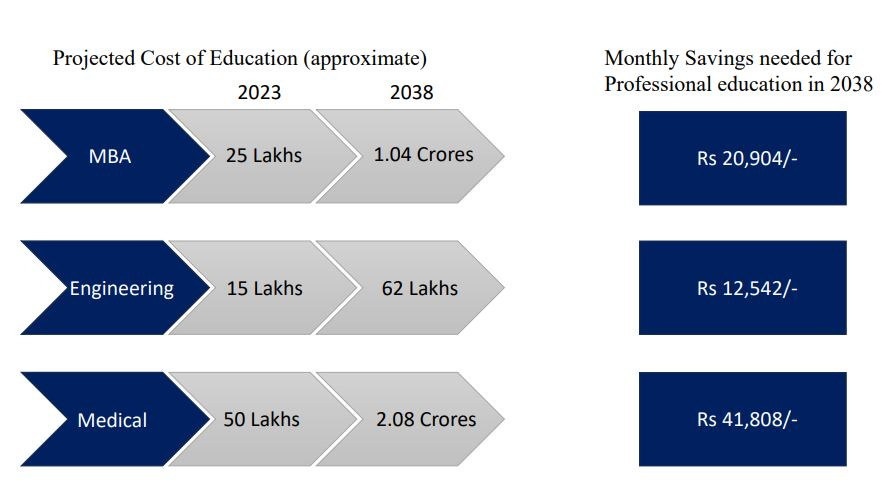

In order to save enough money to pay for college in 15 years, or in 2038, the following monthly savings goals have been calculated:

Inputs taken to calculate the Monthly Savings requirement :

The cost of education in today’s value

Number of years remaining: 15 years

Expected inflation: 10%

Expected returns from mutual fund investments: 12%

In conclusion, the logical approach for new parents is to strike a balance between saving for their child's education and their own retirement. Starting early, setting clear goals, and making informed financial decisions will help them achieve both objectives without compromising one for the other. Consulting with a financial advisor can provide personalized guidance based on their specific situation. Remember, it's possible to save for both education and retirement with careful planning and discipline.

That’s a wrap!

If you found this post helpful, please like, and subscribe so I can bring you more content like this on personal finance.